My friend Roy came by the office today asking me how to start a company. He already has good income coming in from his production business, and is ready to officially become a legitimate corporate entity. I was going to write him an email, but since this might be useful information to other up and coming businessfolk, here you go!

tl;dr: I like LegalZoom, Quickbooks Online, Squarespace, and Chase. There are many other ways. 🙂

How to Start an LLC

It’s really easy to set up a business, and you don’t need to hire a lawyer or consultant anymore. Note: it’s still a super good idea to run business planning through a friend or mentor with experience. This article should be a template; not a be-all, end-all set of recommendations. There are many, many types of businesses, and they’re all different, with different needs. This article is simply a good set of guidelines.

BTW, I’m not getting affiliate fees or any kickback from these recommendations. They’re just ones I’ve used and liked after starting 7 of my own organizations these past 10 years.

1) Form a company.

Your business dealings should always be done through your company, not your personal self. There’s many reasons for this, including limiting your personal liability, and taxes. LegalZoom will do all the corporate setup work, filing with the state, setting up a basic operating agreement, and sending you a fancy kit with your paperwork all in one place. Their pricing starts $149 for the basic version and goes to $359 for the version where they handle everything (all packages have state filing fees as an added cost).

The basic version includes filing the documents with the state, and an operating agreement (the document that you and your partners, if you have them, use to decide how financial and managerial responsibilities are shared in the business).

The next tier up adds 3 free months of QuickBooks Online, and their “Deluxe LLC Kit.” It’s kinda nice, but not necessary if you don’t want it.

The top option, for $359, includes all the above plus filing of your Federal Tax ID number (aka your Employer Identification Number, or EIN, which you can also apply for free at IRS.gov), and access to “over 100 customizable legal forms.” Those forms may be nice if you need them, although I generally feel more comfortable talking to an attorney for forms.

Note: There are many, many online solutions for forming LLCs. There are also many legal groups you can find locally in your area to help you through this. LegalZoom is great and I’ve used them often, but if you prefer to sit down with someone, you can find someone local by Googling “form an LLC [your town]” just as well. You can also file all this paperwork yourself, but it’s best to have someone who’s got experience do this.

2) Get a bank account.

Remember this as you enter the business world: you and your business are wholly separate entities. Once you have a company, you should treat it as it’s own person. If you get a check for $3,000 from a client, that money should be deposited in an account owned by the company. The check should be written to the company. Even if you simply deposit it, and then transfer it right to your own personal account because you’re a small operation, the money should go to the company first, and THEN to you. It’s important for accounting purposes.

Once you get your corporate paperwork showing you have an EIN and are a legitimate LLC registered with your state, head to a bank branch and ask to open a business account. You’ll need a little money to get it started; usually a deposit of $100 is enough for most banks. Any bank will work, but I prefer Chase for a few reasons:

- They have locations all over the US.

- They are great about being on top of the latest technology.

- Because of the above, they have wide integration with most solutions you may need as a small business using technology (QuickBooks, Apple Pay, other accounting and finance softwares).

Set up your account in your company name, making sure to bring your EIN paperwork and state paperwork proving you’ve filed and are a legitimate LLC. You shouldn’t have to pay any kinds of monthly fees for your bank account at this level.

3) Get some accounting software and use it.

Immaculate records equal a better run business, an easier business to sell, an easier business to manage your taxes through, and an easier business for you to bring on a loan or investments as you expand. It also helps you feel more relaxed as a business owner, being able to see your accounting situation clearly at a glance.

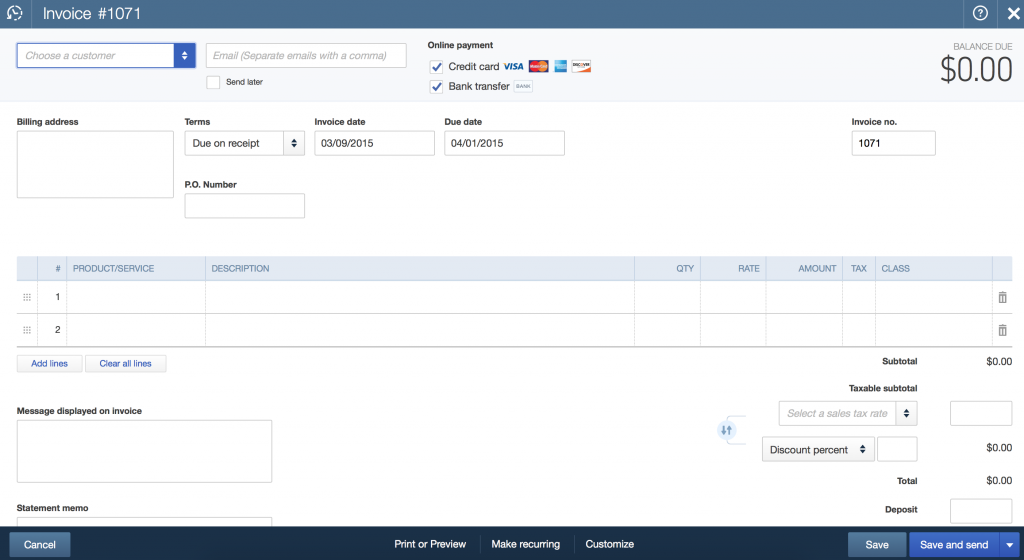

I use Quickbooks Online (QBO), which has an Android and iOS app, as well as Windows and OS X desktop apps. It will also work in a browser. Quickbooks Online costs between $12.95 – $39.95 monthly, depending on your needs (do you have employees? Will you need payroll?).

Quickbooks Online, when connected to your bank account (do that first thing when you set up QBO!), automatically imports your banking transactions, manages your customer base, and allows you to send and track invoices. Your customers will receive invoices by email (you can choose to print as well if you prefer snail mail), and can even pay online through the link sent.

Choose a day each week where you set aside 30 minutes to log in to QBO and categorize all your banking transactions. There’s plenty of online guides how to do this, but it’s fairly easy once you’ve done it a couple times. You can easily grant temporary access to your Quickbooks Online account to your accountant if you prefer to outsource that part, monthly or for tax season.

4) Get a website on your own domain, and an email at your domain.

You need a website. Even if it’s a basic site with not much on it – people are going to Google you, or want to know more about you, or come across you while you’re out and want some info, or want to see your work. These things should be online, where people can see them without you having to see them.

Don’t start a business and then send a “myname@gmail.com” email. Send your business correspondence through a company email, and archive these conversations as you go. You never know when you’ll need to refer back to these conversations, especially in business, often years later.

If you’re a tech person, I prefer getting a WordPress-optimized Bluehost account (~ $13/mo), setting up WordPress, and installing a theme from ThemeForest.net (usually around $45-60). If you’re not a tech-savvy person, Squarespace is great. For $16/mo you get a fully hosted platform which also has e-commerce built in. Add $5/user/month (an email address is considered a user) for Google Apps for Business, and you can manage all your email through Gmail (you can even manage your personal and business emails in once Gmail instance), and also have Google Drive for storing all your business related files.

5) Get some business cards!

Head over to VistaPrint, and order some cards with your new business name, your own name, your phone number, email, and web URL (around $50). Need a logo? For $78, Withoomph will let you design and download one almost instantly.

That’s it! You’re ready to start doing business. Something I forgot, or should add? Chat with me on Twitter, @kylematthews.

A quick summary:

- LegalZoom – $149 – 359, one time.

- Chase bank.

- QuickBooks Online, $12.95 – 39.95, monthly.

- Bluehost or Squarespace, $13 – 21, monthly.

- VistaPrint, ~ $50, one time.

- Withoomph, $78, one time.

- TOTAL: $277 – 487 one time, $25.95 – 60.95 monthly.